Introduction to NXT Tokenomics

Written By Catalin Fetean

Last updated 12 months ago

The NXT token is the backbone of the ecosystem, designed to replace traditional trust mechanisms and unlock new business models in decentralized trade finance. Beyond a simple digital asset, it serves multiple functions, providing liquidity, governance, rewards, and real-world incentives for businesses, investors, and community members.

This guide will break down the economic flow of the NXT token, covering how it fuels the ecosystem, benefits different stakeholders, and supports long-term sustainability.

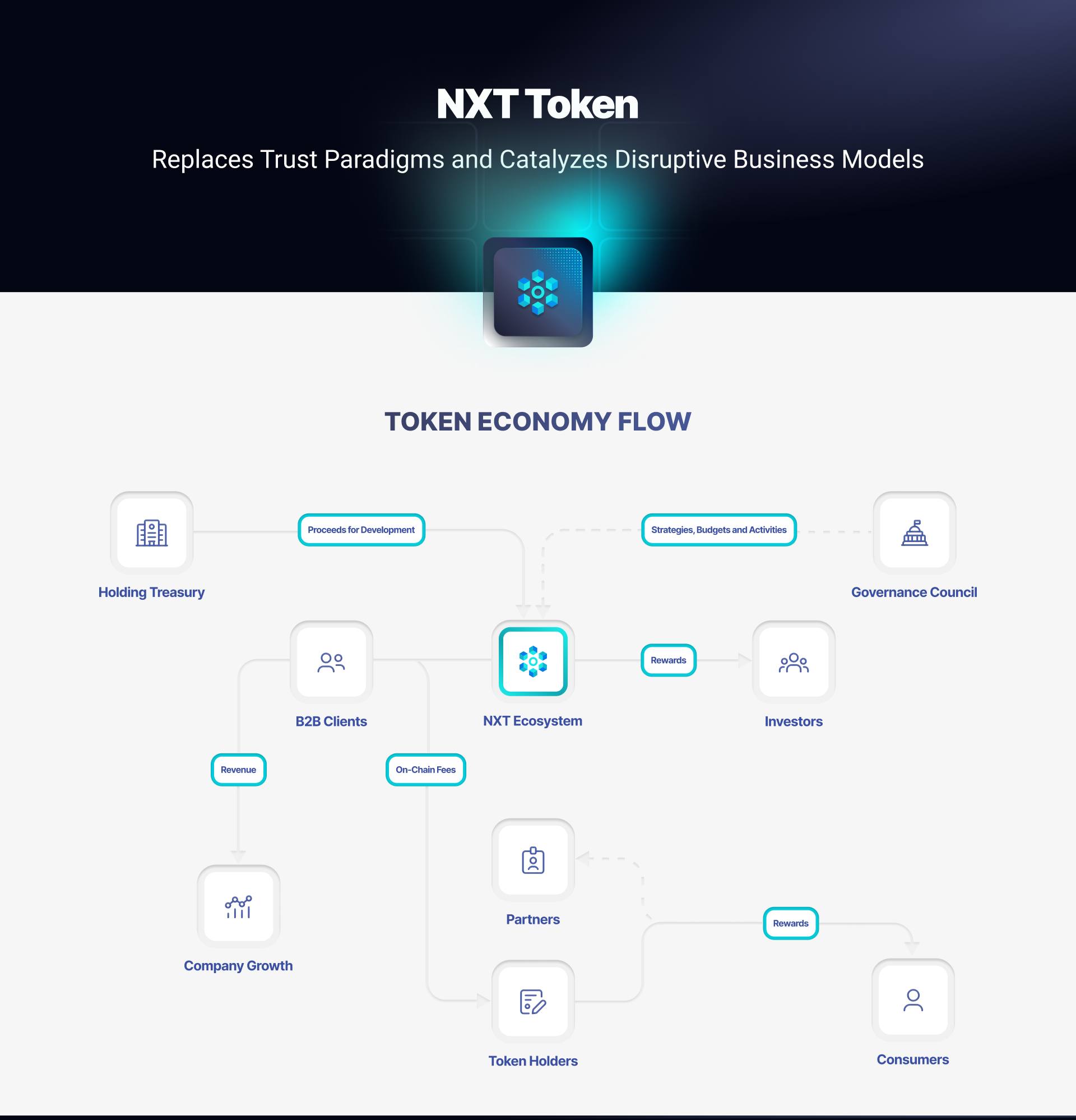

1. The NXT Token Economy Flow

NXT operates within a structured token economy, ensuring that every participant, from individual users to enterprise clients, plays a role in its growth.

Stakeholders and Token Utility

The ecosystem revolves around several key participants:

Governance Council: Oversees ecosystem growth, strategies, budgets, and major decisions.

Investors and Token Holders: Stake tokens, earn rewards, and participate in governance.

B2B Clients and Enterprises: Use the token for trade finance, liquidity pools, and exclusive supplier networks.

Partners and Developers: Contribute to platform expansion, integrate new tools, and develop applications.

Consumers and Community Members: Engage through loyalty programs, ambassador roles, and educational initiatives.

Revenue and Value Flow

On-Chain Fees: Transactions on the platform generate fees that are redistributed to stakers, liquidity providers, and governance participants.

B2B Revenue Model: Businesses using NXT for transactions benefit from lower fees, while enterprises utilizing tokenized finance tools contribute to token circulation.

Treasury and Development: A portion of the ecosystem’s revenue is allocated to innovation, security, and expansion.

2. Token Utility by Stakeholder Group

For Businesses and Enterprise Clients

NXT is structured to provide real economic benefits to companies engaging in global trade.

Exclusive Supplier Network: Businesses using NXT gain access to a vetted supplier network with better pricing, discounts, and perks.

Tiered Fee Reduction: The more NXT a business holds and transacts, the lower its fees, reducing the cost of cross-border settlements.

Trade Finance Access: Enterprises can tokenize contracts and invoices, securing liquidity without relying on traditional banking systems.

For Token Holders

NXT is not just for businesses—it offers multiple incentives for individual users who engage with the platform.

Staking Rewards: Holders can lock up their tokens to earn passive income through yield-generating mechanisms.

Governance Rights: Token holders vote on key proposals, including protocol upgrades, treasury allocation, and ecosystem developments.

Treasury Incentives: The governance treasury periodically distributes rewards to long-term stakers and active governance participants.

For Consumers

NXT integrates into everyday financial interactions, encouraging adoption beyond crypto-native users.

Loyalty Program: A structured rewards system where users earn NXT with each purchase, redeemable for exclusive discounts or products.

Token-Back Rewards: A cashback-style mechanism where users receive a percentage of their spending in NXT, enhancing token circulation.

For Partners and Developers

NXT fosters ecosystem expansion by incentivizing builders and creators.

Affiliate Programs: Developers and businesses can earn tokens for integrating with the platform or referring new users.

Development Bounties: Token grants are available for those who build applications, tools, or UI/UX improvements that enhance usability.

For the Community

The NXT ecosystem thrives on engagement, rewarding users who contribute to its success.

Airdrops and Contests: Periodic token distributions incentivize community participation and growth.

Bounties for Engagement: Users earn tokens by creating content, testing features, or reporting bugs.

Ambassador Programs: High-impact community members get recognized and rewarded for their outreach efforts.

Community Grants: Token-funded initiatives support projects that align with NXT’s mission.

Educational Content: Webinars, workshops, and knowledge-sharing initiatives help onboard and educate users.

Gamification: Leaderboards, achievements, and interactive challenges encourage long-term engagement.

3. Revenue Streams and Sustainability

For the NXT ecosystem to remain sustainable, multiple revenue streams ensure continuous token demand.

3.1 On-Chain Fees & Treasury Growth

Transaction Fees: A percentage of each transaction is allocated to the treasury.

Protocol Revenue: Fees from supply chain financing, staking, and farming.

3.2 Liquidity and Circulation Management

Supply Control: Periodic buybacks and burns prevent inflationary pressure.

Enterprise Demand: B2B partnerships drive organic token usage.

3.3 Token Distribution Model

Staking & Yield Farming: 30% of total supply allocated to staking rewards.

Liquidity Incentives: 25% reserved for market-making and liquidity pools.

Community & Airdrops: 20% allocated for ambassador programs and airdrop campaigns.

Treasury & Development: 15% reserved for long-term project development.

Team & Advisors: 10% vested over a multi-year schedule.

Month | Revenue | Buyback | % of Buyback | Staked NXT | % of Growth | Farming Rewards | % of Growth | Liquidity Pools | % of Growth | Bidding Volume | % of Growth | Ambassadors | Digital Twins Minted | Carbon Offset |

May 2025 | ||||||||||||||

Jun 2025 | $180,338 | $126,237 | 70% | 7,630,000 NXT | (+9% from January) | 1,110,000 NXT | (+13% from January) | 1,630,000 NXT | (+9% from January) | 340,000 NXT | (+13% from January) | 60 | 1200 | 81 Tons |

Jul 2025 | 70% | 8,000,000 NXT | (+5% from February) | 1,150,000 NXT | (+6% from February) | 1,700,000 NXT | (+4% from February) | 360,000 NXT | (+6% from February) | 70 | 1400 | 96 Tons | ||

Aug 2025 | $218,209 | $152,746 | 70% | 8,800,000 NXT | (+10% from March) | 1,260,000 NXT | (+11% from March) | 1,870,000 NXT | (+10% from March) | 400,000 NXT | (+11% from March) | 80 | 1600 | 107 Tons |

Sep 2025 | 70% | 9,240,000 NXT | (+6% from April) | 1,330,000 NXT | (+8% from April) | 1,960,000 NXT | (+5% from April) | 430,000 NXT | (+8% from April) | 90 | 1800 | 123 Tons | ||

Oct 2025 | $264,033 | $184,823 | 70% | 9,760,000 NXT | (+3% from May) | 1,410,000 NXT | (+7% from May) | 2,070,000 NXT | (+6% from May) | 460,000 NXT | (+7% from May) | 100 | 2000 | 166 Tons |

Nov 2025 | 70% | 10,000,000 NXT | (+3% from June) | 1,450,000 NXT | (+4% from June) | 2,130,000 NXT | (+3% from June) | 480,000 NXT | (+4% from June) | 110 | 2200 | 204 Tons | ||

Dec 2025 | $319,480 | $223,636 | 70% | 10,240,000 NXT | (+3% from July) | 1,490,000 NXT | (+4% from July) | 2,190,000 NXT | (+3% from July) | 500,000 NXT | (+4% from July) | 120 | 2400 | 278 Tons |

Jan 2026 | 70% | 10,480,000 NXT | (+3% from August) | 1,530,000 NXT | (+4% from August) | 2,250,000 NXT | (+3% from August) | 520,000 NXT | (+4% from August) | 130 | 2600 | 310 Tons | ||

Feb 2026 | $386,570 | $270,600 | 70% | 10,720,000 NXT | (+3% from September) | 1,570,000 NXT | (+4% from September) | 2,310,000 NXT | (+3% from September) | 540,000 NXT | (+4% from September) | 140 | 2800 | 393 Tons |

Mar 2026 | 70% | 10,960,000 NXT | (+3% from October) | 1,610,000 NXT | (+4% from October) | 2,370,000 NXT | (+3% from October) | 560,000 NXT | (+4% from October) | 150 | 3000 | 460 Tons | ||

Apr 2026 | $467,750 | $327,425 | 70% | 11,200,000 NXT | (+3% from November) | 1,650,000 NXT | (+4% from November) | 2,430,000 NXT | (+3% from November) | 580,000 NXT | (+4% from November) | 160 | 3200 | 628 Tons |

May 2026 | (+3% from December) | (+4% from December) | (+3% from December) | (+4% from December) |

4. Long-Term Growth Strategy

To ensure long-term viability, NXT tokenomics is structured around sustainable utility.

Scaling Enterprise Adoption

Partner with global trade finance institutions to drive token usage.

Expand supplier network integrations to improve tokenized trade efficiency.

Retail Expansion & Adoption

Increase token-based loyalty rewards to attract everyday users.

Develop partnerships with e-commerce and DePIN marketplaces.

Enhanced Governance Mechanisms

Introduce quadratic voting and weighted governance for decentralized decision-making.

Expand community-driven treasury management initiatives.

Token Buyback & Deflationary Mechanics

Implement a portion of transaction fees dedicated to periodic buybacks.

Introduce dynamic token burning for liquidity optimization.

5. Conclusion

The NXT token is more than just a financial asset—it is the foundation of a decentralized, trade-driven economy. Its carefully structured utility across staking, governance, liquidity incentives, and enterprise adoption ensures that it plays a pivotal role in reshaping global finance. By participating in the ecosystem, businesses, investors, and community members all benefit from a self-sustaining economy designed for long-term impact.